our latest news

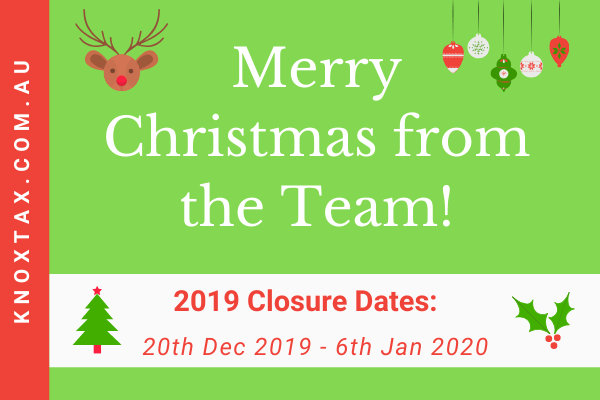

Merry Christmas From the Team & Closure Dates!!

Can you believe that Christmas is just around the corner…again!? It feels like it was yesterday that I was rushing around the shops, multiple bags in hand and scurrying through the crowds to get all my Christmas shopping done before last year’s big day! As we prepare for this year’s Christmas, we wanted to take…

Read More

How to Start a Business: Tips for New Entrepreneurs

Whether you plan to start a business from scratch or grow your existing business, the process can be challenging. As the owner of a start-up small business, you will find yourself pulled in many directions. Many entrepreneurs feel overwhelmed when juggling tasks such as: Creating a business plan Managing your cash flow Settling outstanding payments…

Read More

Single Touch Payroll Reporting – Closely Held Companies

Hey everyone, Following a recent email sent by the ATO on Single Touch Payroll, we felt it important to share the following info with you too. The ATO recently sent an email blast to owners of closely held companies stating that they had missed the Single Touch Payroll (STP) start date. However, this was incorrect…

Read More

How to Claim a Tax Deduction for Personal Super Contributions

This financial year, the ATO have been cracking down on personal super contribution claims because they are wanting to ensure that everyone is following the rules. For some, submitting a Notice of Intent before lodging your tax return seems to be a new process, however, it has been around for a while. The reason you may only…

Read More

ATO Crackdown! | Are You Declaring Foreign Income in Your Tax Return?

Have you been earning money overseas or have an overseas bank account that you deposit money into? Do you have assets or investments overseas? Have you been a bit naughty by “accidentally” omitting this income from your tax return? If so, this article applies to you. What is Foreign Income? In simple terms, foreign…

Read More

What is the New $1080 low and middle income tax offset?

During the 2019–20 Federal Budget the Government announced its desire to change the policy regarding Personal Income Tax. Recently, it was announced that these changes have been passed through and are law as a new income tax offset. So, what will this mean for you? And what is a tax offset in the first place?…

Read More

Claiming Work-Related Expenses | Part 2 – Claiming Car Expenses

As we mentioned in the first article of this series; “4 Things You Should Know Before Claiming Work-related Expenses“, you may be entitled to claim certain deductions for work-related expenses in your tax return. But: You must have spent the money out of your own pocket You mustn’t have been reimbursed for it already It…

Read More

Claiming Work-Related Expenses | Part 1 – 4 Things You Should Know!

When completing your tax return, you’re entitled to claim deductions for certain expenses directly related to your income. To successfully claim a deduction for work-related expenses: You must have spent the money out of your own pocket You must have not been reimbursed for it already It must be directly related to earning your…

Read More

Outstanding or Late Tax Returns? 2 Simple Tips to Fix Them.

As you may know, it’s compulsory for Australians to lodge a tax return every year. Despite this, late tax returns are more common than you think. Many taxpayers find themselves falling behind and are embarrassed upon realising that they have multiple years of outstanding tax returns – whoops! Time can fly by so quickly, that…

Read More

Why Year-End Tax Planning is Important, even for Individuals!

If you could pay less tax this year what would you do with the extra money? Would you use it to: Reduce your home loan? Top up your Superannuation fund? Save for your dream holiday? Buy a new car? Build a deposit for an investment property? Save for your child’s education? Year-end tax planning season…

Read More

Download your FREE Business Tax Return Checklist

You have Successfully Subscribed!

Download your Property Investor - Starter Pack

Enter your email below to receive your FREE property and tax guide now.

By joining the Knox Tax community you will also remain up-to-date with the latest news and tips from our team.

Success! Your Property Investor Starter Pack is on its way

Download your Small Business Start-Up Pack

Enter your email below to receive your FREE business guide now.

By joining the Knox Tax community you will also remain up-to-date with the latest news and tips from our team.