As we find ourselves in the midst of the FBT season, we wanted to chat about what FBT is, and if this applies to you!

Fringe Benefits Tax (FBT) is tax that is paid by employers to cover certain benefits provided to their employees. Please note, this is separate to Income Tax.

What are the dates for the 2024 FBT year?

The current FBT year is from 1 April 2023 to 31 March 2024, all benefits provided during this time will need to be assessed to determine if they are taxable.

What is deemed as a Fringe Benefit?

To give you an idea on what is deemed a fringe benefit, see below:

- allowing yourself, an employee and your associates to use a work car for private purposes. If a vehicle is owned by the entity and used for private purposes, there may be a FBT Liability

- car parking

- paying an employee’s gym membership

- providing entertainment by way of free tickets to concerts

- reimbursing an expense incurred by an employee, such as school fees

- giving an employee a discounted loan

- giving benefits under a salary sacrifice arrangement with an employee

If you are a sole trader or a partner in a partnership, you are not an employee. Therefore, benefits you provide to yourself are not subject to FBT.

Motor Vehicles

When a business owns or leases a motor vehicle that an employee uses for personal purposes, such as commuting between home and the workplace, fringe benefits tax (FBT) will be applied.

Benefits provided for electric cars are exempt from FBT if all the following criteria are met:

- the car is a zero or low emissions vehicle

- the first time the car is both held and used is on or after 1 July 2022

- the car is used by a current employee or their associates (such as family members)

- luxury car tax has never been payable on the importation or sale of the car.

FBT due dates

The due date for the FBT return is 21st of May, unless you lodge your FBT return through a tax agent, then the due date is 25th of June 2024.

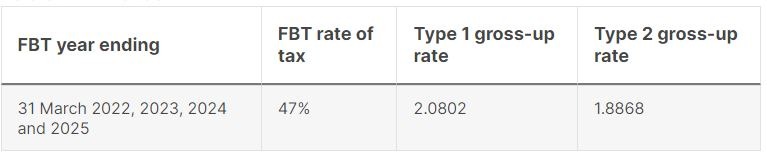

FBT Rates:

Fore more information on FBT, please CLICK HERE to be directed to the ATO website.

If you have any questions on FBT returns, please call our office & have a chat with one of our accountants.

Regards,

The teat at Knox Taxation