If you really want to own and run a successful business, year-end tax planning must be incorporated into your annual planning and overall business strategy.

As you’ve probably heard a million times over, “Failing to plan is planning to fail.” Rather than just skimming over that statement, really ask yourself:

Do you understand the implications of effective planning for your business?

The Stats on Business Failure

According to the Australia Bureau of Statistics:

- 20% of small businesses fail in their first year

- 30% of small business fail in their second year

- 50% of small businesses fail after five years in business

- 70% of small business owners fail in their 10th year

AND one of the biggest reasons for business failure is poor cash flow!

Given that’s the case, as a business owner, why wouldn’t you want to invest as much as you can in effectively planning your tax situation to remove the likelihood of added stress on your accounts at EOFY?

This is where year-end planning comes in and why it is truly critical for business success.

If you could reduce the amount of tax you pay each year what would you do with the extra cash?

Would you use it to:

- Reduce your home loan?

- Top up your Superannuation fund?

- Save for your dream holiday?

- Buy a new car?

- Build a deposit for an investment property?

- Save for your child’s education?

Well, the 30th of June is sneaking up very quickly which means that the season for year-end tax planning is just around the corner. It’s time for us to kick into gear and work with you to get your affairs in order before EOFY.

Together we can implement tax effective strategies to positively influence your situation, before it’s too late!

6 Ways Year-end Tax Planning Can Benefit You and Your Business

Our expert tax planning advice can help to:

- Provide you with peace of mind

- Reduce any stress or anxiety you may be feeling about EOFY

- Ensure you’re not paying more tax then you need to

- Prepare you ahead of time for any tax payable so you can plan for it

- No more nasty surprises or the anxiety that comes with discovering you’re payable but have not set aside funds to cover it, leaving you scrambling for cash you may not have…

- Successfully plan and manage your cash flow

- Increase your wealth over time by investing saved tax money elsewhere with greater ROI

To book your appointment give us a call today on (03) 9762 7344.

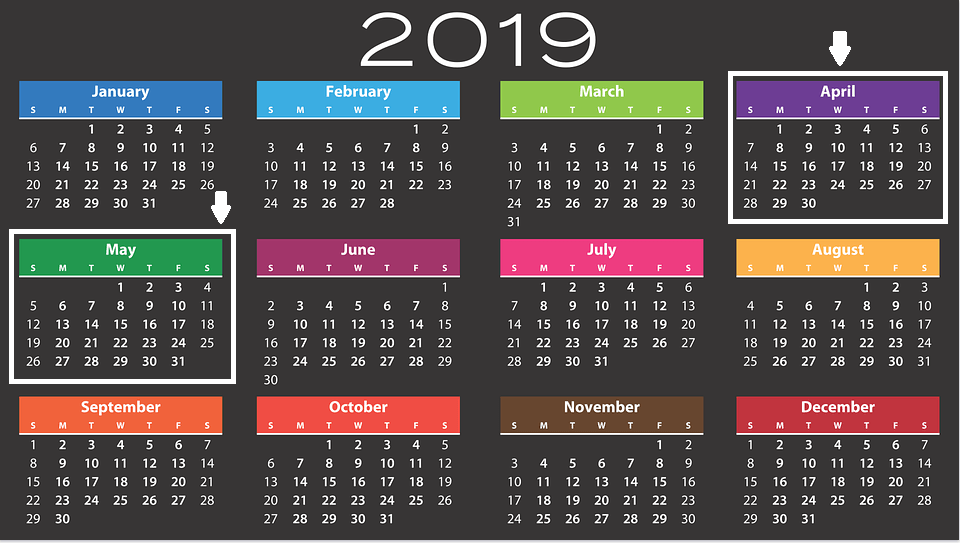

April & May – The Perfect Months for Year-end Tax Planning

As business owners, we’re often pulled in multiple different directions at the same time.

Because of this, some of you may be thinking:

- “Oh yeah, tax planning. I should probably do that, but I’m crazy busy right now so don’t have the time…” or

- “Na. I don’t need tax planning. I’ll just wing it and see what happens!”

The problem with procrastination, denial and not taking the appropriate action is that all of these mindsets are about as effective as a cat-flap in a house of elephants.

If you choose to leave planning until the end of May or early June, there’s not going to be much we can do to help you.

Yet, over April and May the timing is PERFECT!

We have your figures for ¾ of the year (so we can make accurate forecasts) and there’s still a few months left before EOFY. Therefore, we have time to action the right strategies to improve your position before EOFY.

We’ve truly seen the consequences of poor planning first hand, including those who do not plan effectively for EOFY and end up in quite a financial pickle. Especially from a cash flow perspective.

We really don’t want this to be you.

This is why we’re inviting you to book your Tax Planning appointment with your accountant early to start the process early. View year end planning as an investment for your business’ success.

Let us help you to get the most out of the final months of FY19, so we can do our best to look after you and support the success of your business.

What You Can Expect From Your Year-end Tax Planning Appointment

In preparation for your Year-end Tax Planning appointment, your accountant will need you to provide your expected income and business profits for the 2019 tax year (1 July 2018 to 30 June 2019).

This will include any:

- Wages / employment income

- Interest, dividends and rental income received

- Business profits / losses; and

- Capital gains / losses you expect to make.

Based on your forecasted income and expenses, they will be able to calculate an estimate for your taxable income and your tax payable (before the application of any tax planning strategies).

Once an estimate has been calculated, they will be able to discuss and explore your options. This may include certain tax saving strategies that are relevant to your personal situation or your business.

Our team will be able to explain these strategies using simple terminology that you can understand, so that you’re able to assist us in actioning them before the 30th of June.

Before you appointment, we recommend running your eyes over the following guides as they will give you a brief insight into some of the potential strategies we can implement.

Before you appointment, we recommend running your eyes over the following guides as they will give you a brief insight into some of the potential strategies we can implement.

Not all of these strategies may be applicable to your situation, however having a basic understanding of what they are before your appointment can be very valuable.

Note: Some of the tax strategies in the above Tax Planning Guides could be subject to change depending on which political party wins the 2019 election. But, we will notify you and address any policy changes after the election has taken place.

To get the ball rolling, give us a call on (03) 9762 7344 to organise your appointment.