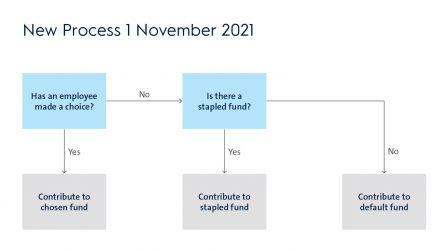

From 1 November 2021, if you have a new employee start and they don’t choose or provide a super fund to you, you may need to request their “stapled super fund” details from the Australian Taxation Office.

A stapled super fund is an existing super account linked to an individual. This super account will follow the employee as they change jobs.

The aim of the stapled super fund is to avoid new super account being opened every time a new employee starts a new job, which will also reduce account fees.

If your new employee chooses a super fund of their choice, you don’t need to request your new employees stapled super fund.

When to request stapled super fund details:

You will need to request stapled super fund details on or after 1 November 2021 when:

- When your new employee is eligible to choose a super fund, but don’t

- you need to make super guarantee payments for that employee

You may have new employees that are not eligible to choose their own super fund. These are new employees that are:

- temporary residents

- covered by an enterprise agreement or workplace determination made before 1 January 2021.

Steps to requesting stapled super fund details:

- First, you will need to offer your new employee a choice of super fund. Your employee can provide you with their choice of super fund.

- You can then request the employees stapled super fund details using ATO online services using the steps below:

- Log into ATO online services

- Then via the “Employees” menu, select “Employee super account”

- Enter your employees details including: TFN, Full name, DOB and address

- Read and sign the declaration

- Submit your request

If you have 100 or more employees to request stapled super funds for, you can do a bulk request – click here to access the bulk form.

If you are unable to access the ATO online Services page, you can alternatively call 13 10 20

For further information regarding Stapled Super Funds, click here to be re-directed to the ATO webpage.

If you have any questions, please contact our office on (03) 9762 7344

Regards,

The Team @ Knox Taxation and Business Advisory