Happy Wednesday,

Today we wanted to help explain the latest changes to the Government’s 2020/21 Federal Budget.

There’s been a lot of confusion around the budget and yes, trying to get your head around all the changes yourself can be overwhelming.

Although a bit dry, stay with us as we do our best to explain the key concepts in layman’s terms.

Here are some critical snippets we believe you should focus on, as highlighted by the NTAA:

1. Personal income tax changes

Changes to personal income tax rates

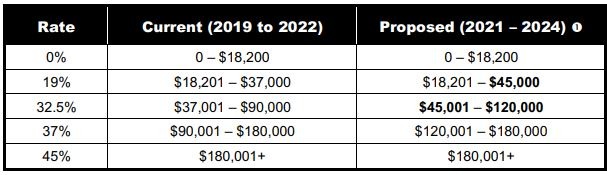

The Government has announced that it will bring forward changes to the personal income tax rates

that were due to apply from 1 July 2022 to 1 July 2020 (i.e. from the 2021 income year).

The key changes involve:

- increasing the upper threshold of the 19% personal income tax bracket from $37,000 to $45,000;

and - increasing the upper threshold of the 32.5% personal income tax bracket from $90,000 to

$120,000.

You can see a summary of these changes in the table below (which excludes the Medicare Levy):

** The Government have advised that the personal income tax rate changes that have already been

legislated, effective from 1 July 2024 (i.e., from the 2025 income year), remain unchanged.

**These involve abolishing the 37% personal income tax bracket, reducing the 32.5% personal income tax bracket to 30%,

and increasing the upper threshold of the reduced 30% tax bracket from $120,000 to $200,000.

2. Changes Affecting Business Taxpayers

a) Expanding access to Small Business Tax Concessions

The Government has also announced that it will be expanding the concessions available to Medium Sized Entities.

Medium sized entitles are now able to gain access to up to ten Small Business Concessions.

But what is a medium sized entity?

In this context, a Medium Sized Entity is an entity with an aggregated annual turnover of at least $10 million and (less than) $50 million.

The expanded concessions will apply in three phases, as follows:

- From 1 July 2020, eligible businesses will be able to immediately deduct certain start-up expenses and certain prepaid expenditure.

- From 1 April 2021, eligible businesses will be exempt from FBT on car parking and multiple work-related portable electronic devices, such as phones or laptops, provided to employees.

- From 1 July 2021:

- Eligible businesses will be able to access the simplified trading stock rules, remit pay as you go (PAYG) instalments based on GDP adjusted notional tax and settle excise duty and

excise-equivalent customs duty monthly on eligible goods. - Eligible businesses will generally have a two-year amendment period apply to income tax assessments for income years starting from 1 July 2021.

- The Commissioner of Taxation’s power to create a simplified accounting method determination for GST purposes will be expanded to apply to businesses below the $50 million aggregated annual turnover threshold.

- Eligible businesses will be able to access the simplified trading stock rules, remit pay as you go (PAYG) instalments based on GDP adjusted notional tax and settle excise duty and

b) JobMaker Hiring Credit

The Government will introduce a JobMaker Hiring Credit to incentivise businesses to take on additional young job seekers.

From 7 October 2020, eligible employers will be able to claim $200 a week for each additional eligible employee they hire aged 16 to 29 years old and $100 a week for each additional eligible employee aged 30 to 35 years old.

New jobs created until 6 October 2021 will attract the credit for up to 12 months from the date the new position is created.

The JobMaker Hiring Credit will be claimed quarterly in arrears by the employer from the ATO from 1 February 2021.

Employers will need to report quarterly that they meet the eligibility criteria.

The amount of the credit is capped at $10,400 for each additional new position created.

Furthermore, the total credit claimed by an employer cannot exceed the amount of the increase in payroll for the reporting period in question (see employer eligibility requirements below).

Who is an eligible employee?

Employees may be employed on a permanent, casual or fixed term basis.

To be an ‘eligible employee’, the employee must:

- be aged (i.e., at the time their employment started) either:

– 16 to 29 years old, to attract the payment of $200 per week; or

– 30 to 35 years old to attract the payment of $100 per week; - have worked at least 20 paid hours per week on average for the full weeks they were employed

over the reporting period; - have commenced their employment during the period from 7 October 2020 to 6 October 2021;

- have received the JobSeeker Payment, Youth Allowance (Other), or Parenting Payment for at least one month within the past three months before they were hired; and

- be in their first year of employment with this employer and must be employed for the period that the employer is claiming for them.

Certain exclusions apply, including employees for whom the employer is also receiving a wage subsidy under another Commonwealth program.

Who is an eligible employer?

An employer is able to access the JobMaker Hiring Credit if the employer:

- has an ABN;

- is up to date with tax lodgement obligations;

- is registered for Pay As You Go withholding;

- is reporting through Single Touch Payroll;

- is claiming in respect of an ‘eligible employee’;

- has kept adequate records of the paid hours worked by the employee they are claiming the hiring credit in respect of; and

- is able to demonstrate that the credit is claimed in respect of an additional job that has been created. Ie. there must be an increase in the business’ total employee headcount and also in the payroll of the business for the reporting period (based on a comparison over a

specified reference period.

Employers do not need to satisfy a fall in turnover test to access the JobMaker Hiring Credit.

Certain employers are excluded, including those who are claiming the JobKeeper payment.

New employers created after 30 September 2020 are not eligible for the first employee hired but are (potentially) eligible for the second and subsequent eligible hires.

c) Tax-free business support grants

The Government has announced that the Victorian Government’s Business Support Grants for small and medium businesses, as announced on 13 September 2020 are TAX FREE!

The Government may extend this arrangement to similar future grants from all States and Territories on an application basis.

Eligibility for this treatment will be limited to grants announced on or after 13 September 2020 and for payments made between 13 September 2020 and 30 June 2021.

d) Uncapped immediate write-off for depreciable assets

The Government has announced it will introduce the following changes to the Capital Allowance provisions:

(a) Businesses with an aggregated annual turnover of less than $5 billion will be able to claim an immediate deduction for the full (uncapped) cost of an eligible depreciable asset, in the year the asset is first used or is installed ready for use, where the following requirements are satisfied.

The asset:

- was acquired from 7:30pm AEDT on 6 October 2020 (i.e., Budget night).

- was first used or installed ready for use by 30 June 2022.

- is a new depreciable asset or is the cost of an improvement to an existing eligible asset, unless the taxpayer qualifies as a small or medium sized business (i.e., for these purposes, a business with an aggregated annual turnover of less than $50 million), in which case the asset can be second-hand.

(b) As is currently legislated, businesses with aggregated annual turnover between $50 million and $500 million can still deduct the cost of eligible second-hand assets costing less than $150,000 that are purchased from 2 April 2019 and first used or installed ready for use between 12 March 2020 and 31 December 2020 under the enhanced instant asset write-off.

The Government has announced that it will extend the period in which such assets must first be used or installed ready for use by 6 months, until 30 June 2021.

(c) Small businesses (i.e., with aggregated annual turnover of less than $10 million) can deduct the balance of their simplified depreciation pool at the end of the income year while full expensing applies (i.e., up to 30 June 2022).

Furthermore, the provisions which prevent small businesses from re-entering the simplified depreciation regime for five years if they opt-out will continue to be suspended

3. Changes affecting companies

a) Temporary loss carry back for eligible companies

The Government has announced that it will introduce measures to allow companies with a turnover of less than $5 billion to carry back losses from the 2020, 2021 or 2022 income years to offset previously taxed profits made in or after the 2019 income year.

b) Clarifying the corporate residency test

The corporate residency rules are fundamental to determining a company’s Australian income tax liability.

The Government will amend the law to provide that a company that is incorporated offshore will be treated as an Australian tax resident if it has a ‘significant economic connection to Australia’.

This test will be satisfied where both the company’s core commercial activities are undertaken in Australia and its central management and control is in Australia.

4. Other budget announcements

a) Removing CGT for ‘granny flat arrangements’

A targeted CGT exemption will apply from 1 July 2021 (subject to the passing of legislation), for ‘granny flat arrangements’.

Broadly, these involve older Australians or people with disabilities transferring their home or the proceeds from the sale of their home (and/or other assets) to their adult children or other trusted persons in return for the promise of ongoing housing and care.

b) Superannuation reforms

From 1 July 2021, your superannuation will now follow you.

This means that any existing superannuation accounts will be ‘stapled’ to a member to avoid the creation of a new account when that person changes their employment.

c) Mental Health – COVID-19 response package

The Government will provide $7 million in 2020/21 to support the mental health and financial wellbeing of small businesses impacted by COVID-19, including:

- $4.3 million to provide free, accessible and tailored support for small business owners by expanding Beyond Blue’s New Access program in partnership with the Australian Small

Business and Family Enterprise Ombudsman; and - $2.2 million to expand a free accredited professional development program that builds the mental health literacy of trusted business advisers so that they can better support small business

owners in times of distress, delivered through Deakin University.

d) Insolvency reforms to support small business

The Government will implement certain insolvency reforms, effective from 1 January 2021 (subject to the passing of legislation) to support small business, including the following:

- The introduction of a new streamlined process to enable eligible incorporated small businesses (broadly, those with liabilities of less than $1 million) in financial distress to restructure their debt.

- Simplifying the liquidation process for eligible incorporated small businesses (to allow faster and lower-cost liquidations, increasing returns for creditors and employees).

- Support for the insolvency sector (to ensure it can respond effectively to increased demand and to the needs of small business).

All information within this article has been sourced from the following NTAA’s 2020/21 Federal Budget article.

We hope that it has helped to summarise 2020/21 Federal Budget changes, that may impact you or your business.

If you’d like to read the above in even more depth and about other Budget Changes, you can download it here.

We wish you a safe & healthy day!