In February 2020, legislation came into effect that requires all employers to start reporting their payroll through Single Touch Payroll from 1 July 2019.

Employers were given until 30 September 2019 to start reporting without needing to apply for additional time.

As an employee, these changes mean that your tax and super information is now accessible to the ATO when you are paid by your employer.

This has reduced the requirement for many employers to provide payment summaries at EOFY. Instead, you are able to view your year-to-date tax and super information through a myGov account.

But here’s some things you may not know, or may not have considered.

If this article doesn’t answer all of your questions relating to MyGov accounts, feel free to give our team a call on (03) 9762 7344.

Do you really need a MyGov Account?

Some employers are starting to push employees to create myGov accounts as part of the STP reporting process. But, despite what some say or think, having a myGov account is NOT COMPULSORY.

As an employee, you shouldn’t feel forced to get a MyGov account (even despite the STP changes) because you can access your wages information using other methods. For example, you can also request a copy of your payment summary from your employer, accountant or even the ATO at EOFY.

But do note, you may you may need to wait until after the 31st of July to get a copy is because that is the deadline for employers to finalise their employee payments.

If you choose to use a myGov account linked to the ATO, you will be able to access your information as soon as it is available.

But there are some downsides of this method which we’ll explain more about below.

What is the link between Single Touch Payroll and MyGov accounts?

If you haven’t heard much about Single Touch Payroll (STP) before, you can read up on it here.

Simply, the reason that MyGov accounts have increased in popularity this year (from a tax perspective) is because employers are no longer required to provide payment summaries to their staff.

Therefore, it provides a way to access the information via a government app.

Things to consider when setting up a MyGov Account

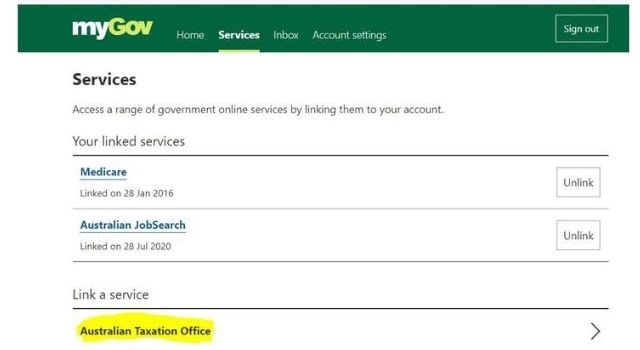

When setting up your myGov account, you’ll be asked to link any relevant government services to your account. This could include Centrelink, Medicare, ATO, etc. During this process, there is one IMPORTANT thing to keep in mind.

As soon as you link the “ATO” to your myGov account, you’re actually giving the ATO permission to send all tax correspondence to your personal myGov account.

Now that the correspondence is being sent to you directly, and not your accountant (as normal), the ATO expects you to action and handle everything yourself.

Here’s a snippet from the ATO Terms and Conditions agreement:

“I agree my myGov inbox will be my address for the ATO to send correspondence. This includes items that may have previously gone to my tax or BAS agent, if I have one. My agent will be able to access my correspondence electronically.”

This could become a BIG problem if you choose this option by accident or don’t regularly check your myGov account.

The Key Problem is in the T & C’s

By agreeing to this clause, you agree that all tax-related correspondence will now be sent directly to your myGov account, bypassing the safekeeping of your accountant. It will be 100% your responsibility to check your ATO correspondence regularly.

Failure to do so may result in penalties and fines.

Although your accountant may be able to access your correspondence electronically, they won’t receive any notifications. Therefore, how are they to know to you’ve received something important?

Our recommendation is that you leave this box unchecked, so that all all tax correspondence remains being sent to us (you accountants) and we can action it on your behalf.

That way you won’t miss out on any critical information or alerts, as we will only get in touch when needed.

In Summary – You don’t NEED a MyGov account.

We’re not saying that setting up a MyGov account is a bad thing, but we wanted to articulate the important fact that it isn’t compulsory.

There are also some possible consequences of linking the ATO to your myGov account without reading the fine print.

For example:

- It will be entirely up to you to keep up to date with ATO correspondence

- You will become solely responsible for notifying us (your accountant) if you have any ATO concerns

- You must check your MyGov account regularly for any ATO communication

- If you forget to check your account and miss an overdue debt penalty, they will hold you 100% accountable – and in some cases, even threaten legal action.

We’ve already seen a few cases of some clients experiencing this problem; receiving accelerated ATO fines and pending legal action due to not checking their myGov account properly.

If you’re still not sure what you need to do, give us a call on (03) 9762 7344.

Our Recommendation on MyGov Accounts:

1. If you don’t have a myGov account

No need to worry! You don’t need one (at this stage, anyway).

2. If you do already have a myGov account or are planning to set one up:

Be very careful linking the “ATO” as a Service

3. If you have a myGov account and still want to link the ATO as a Service

- You must check your account “Inbox” regularly to action any urgent correspondence

- Possibly change your myGov account settings so that “Inbox Notifications” are sent to your mobile as a text – not to your email.

- Keep in mind that we may not be able to advise or fix ATO related concerns, unpaid fines or penalties that come through to your myGov account.

At Knox Taxation and Business Advisory we make sure that everything related to your Tax compliance is taken care of and simple.

We want to make Tax as stress-free as possible – without our clients having to worry about concerns like this. That’s why we recommend that you leave your ATO correspondence to us.

This way, we can continue to receive, control and take care of your ATO correspondence; notifying you immediately for anything urgent.

If you’re interested in learning more about us and the services we offer, you can check out:

- Our Services (Business, Individuals & Property Investors)

- Our Team and History , or

- Contact us to Book an Appointment

If you have any queries or questions feel free to give us a call on (03) 9762 7344 to discuss this further.

Other than that, we wish you all a great week!