Note: This information is for people who:

- Make personal super contributions from their income after tax (this does not include contributions made under a salary sacrifice arrangement and compulsory super paid by your employer), and

- Want to claim a deduction for these contributions.

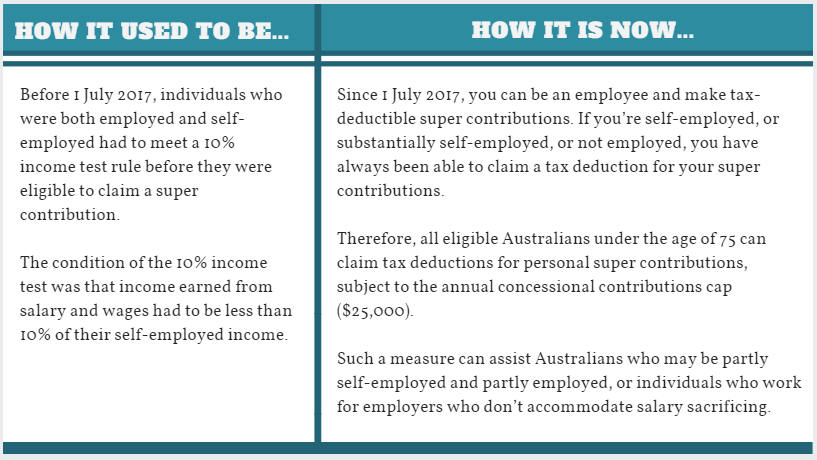

Since the 1st July 2017, the eligibility rules for claiming a tax deduction for personal superannuation contributions have changed. Don’t worry! It’s a good change and it may even make you better off.

Here is a summary of what you need to know:

What’s really changed?

Concessional (before-tax) contributions cap

The super contributions that you claim as a deduction in your tax return will count towards your concessional contributions cap. If you exceed your cap, you will have to pay extra tax.

Generally speaking, you can make two types of super contributions: non-concessional (after-tax) contributions and concessional (before-tax) contributions.

Concessional contributions include Superannuation Guarantee contributions (made by an employer), salary sacrifice contributions, and tax-deductible super contributions. A tax-deductible super contribution relates to when an individual claims a deduction for making a super contribution.

For the 2017/2018 year (from 1 July 2017 to 30 June 2018), an eligible individual can make concessional contributions of up to $25,000.

You can find more information about concessional contributions via the ATO website.

Alternatively, give us a call and we can walk you through it – (03) 9762 7344.

Does this effect you and are you eligible?

Since 1 July 2017, you can be an employee and make tax-deductible super contributions. If you’re self-employed, or substantially self-employed, or not employed, you have always been able to claim a tax deduction for your super contributions.

You may be able to claim a tax deduction if you get your income from:

- salary and wages

- a personal business (for example, self-employed)

- investments (including interest, dividends, rent and capital gains)

- government pensions or allowances

- super

- partnership or trust distributions

- a foreign source

You are not eligible if you are a member of a/an:

- Commonwealth public sector superannuation scheme

- Untaxed fund such as a constitutionally protected fund (CPF)

- Certain funds that offer defined benefit interests

If you’re a member of one of these funds, you are not eligible to claim a deduction for contributions made to these funds. However, if you want to be eligible to claim a deduction, you would need to make personal super contributions to another eligible super fund.

To read more information about eligibility and the super contribution changes, you can visit the ATO website.

How can I claim this tax deduction?

Easy Peasy – just give us a call. By speaking with your accountant we can first determine whether you are eligible. Then we can ensure that this deduction is included as part of your annual tax return.

At Knox Taxation and Business Advisory we focus on building long-term relationships with our clients. We love to provide additional value to our clients, alongside the many services that we offer. Our staff will be more than happy to help you.

We provide a caring and personalised service, whilst helping you to legally minimise your personal Income Tax liability, and implement tax-effective strategies to boost your personal wealth.

For more information about our Tax & Business Advisory services, click here.