Latest Notification from the State Revenue Office (SRO) due 15 January:

“Notifications for vacant residential land tax and the absentee owner surcharge are due by 15 January 2019.

If you made a notification last year, you only need to make a new one if your circumstances have changed.”

Vacant Residential Land Tax:

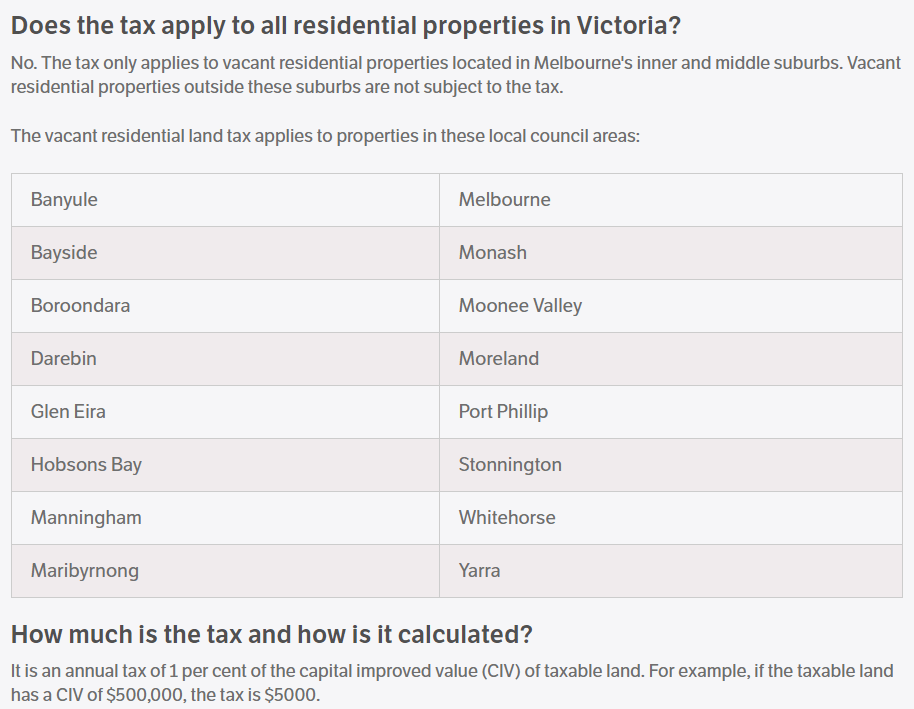

“If you own a property in one of 16 council areas that was unoccupied for six months or more in 2018, you must notify the SRO via their vacant residential land tax portal.”

See below the list of impacted council areas:

Absentee Owner Surcharge:

An absentee owner surcharge applies to Victorian land owned by an absentee individual, corporation or trust. If you are an absentee owner, you must notify the SRO via their absentee owner notification portal.

Clearance Certificate Payment Options Delayed

New options for paying the tax listed on land tax clearance certificates have been delayed and will now be available in early 2019.

Once the new options are available, certificates will allow you to pay by credit card or BPAY.”

If you have any questions about this latest update, please don’t hesitate to contact us on (03) 9762 7344.